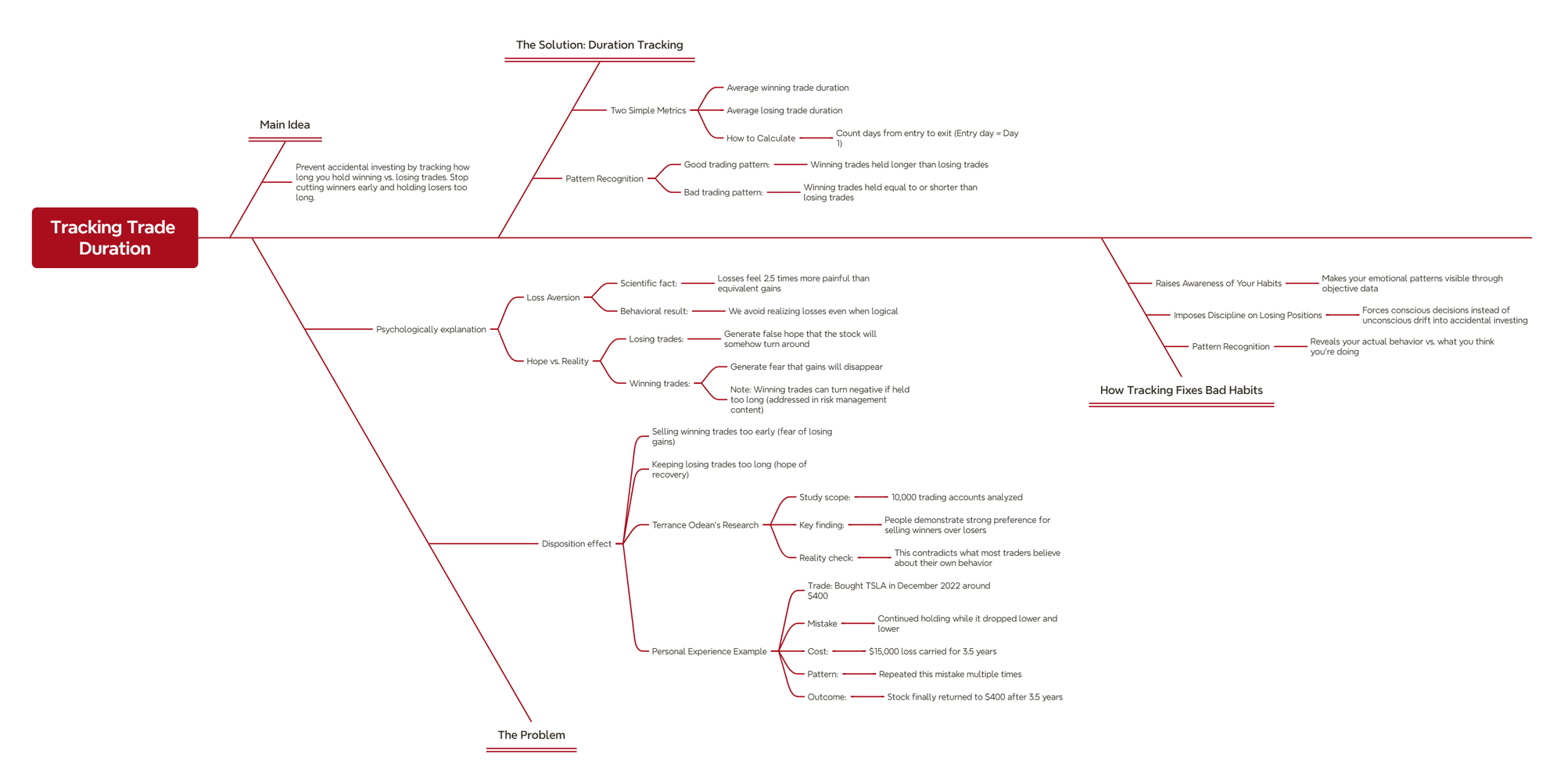

Why Trade Duration Tracking Prevents Accidental Investing

You're sabotaging your returns by holding losers too long. Discover how trade duration tracking exposes emotional biases and prevents accidental investing – backed by real data.

You're sabotaging your own returns, and the data proves it. The metric you're not tracking reveals exactly how emotions are costing you money.

The Hidden Pattern Destroying Your Returns

Most traders obsess over win rates, profit targets, and risk-reward ratios. They track everything except the one metric that reveals why they're actually losing money: how long they hold winning trades versus losing trades.

- Here's what you probably believe: "I cut my losses quickly and let my winners run."

- Here's what the data shows: You're doing the exact opposite, and you don't even realize it.

The $15,000 Lesson in Accidental Investing

I bought Tesla in December 2022 around $400. My system said exit. I didn't listen.

What I told myself: "I'm being patient with a quality company." What I was actually doing: Avoiding the pain of admitting I was wrong.

The position dropped and kept dropping. $15,000 down. Three and a half years of watching red numbers, making excuses, and telling myself it would "come back." It finally returned to $400 this week—three and a half years later.

The uncomfortable truth I had to face: Every day I held that losing position was a day I chose hope over strategy.

In project management, we also have a saying "Don't plan on hope."

This wasn't patience. This wasn't investing in a great company. This was me being unable to accept that I was wrong, disguising my fear as conviction. The stress wasn't from the market—it was from knowing I was violating my own rules and pretending it was smart.

What are you unwilling to admit about the positions you're holding too long?

I repeated this pattern multiple times. Tesla was just the most expensive teacher. Each time, I convinced myself I was being "strategic" when I was actually letting my ego override my discipline. The market doesn't care about your ego, but your account balance does.

The Disposition Effect: Why Your Brain Works Against You

In a landmark study published in The Journal of Finance, behavioral economist Terrance Odean analyzed trading records from 10,000 accounts at a large discount brokerage house from 1987 to 1993. His findings shattered what most traders believe about their own behavior.

The devastating discovery: When investors had both winning and losing stocks in their portfolios, they were 50% more likely to sell the winners. They consistently chose to lock in small gains while giving their losses more time to "hopefully recover."

The mathematical reality:

- Investors sold winning stocks at a much higher rate than losing stocks

- This pattern held consistent across 97,483 transactions over 7 years

- Result: People were systematically cutting winners early and holding losers too long

The psychological reality behind this destruction:

- Loss aversion: Losses feel 2.5 times more painful than equivalent gains

- False hope: Losing trades generate hope that "somehow the stock will turn around"

- Fear of loss: Winning trades generate fear that gains will disappear

The performance cost: Odean found that the winning stocks investors sold continued to outperform the losing stocks they held by an average of 3.4% over the following year. This behavior was "suboptimal and leads to lower after-tax returns."

What your emotions tell you: "This loss might recover, but this gain might disappear."

What profitable trading requires: "Cut losses quickly, let winners run."

What the data proves: You're doing the exact opposite without realizing it.

Your brain is literally wired to do the wrong thing. Duration tracking gives you objective data to override these destructive instincts.

The Duration Test: Good vs. Bad Trading Patterns

Track these two simple metrics in your trading journal:

- Average winning trade duration

- Average losing trade duration

How to calculate duration: Count from your entry date to your exit date. If you buy on Monday and sell on Wednesday, that's a 3-day duration (Monday = Day 1, Tuesday = Day 2, Wednesday = Day 3).

Good trading pattern: Winning trades have longer duration than losing trades Bad trading pattern: Winning trades have equal or shorter duration than losing trades

Example of destructive duration patterns:

- Winning trades: Average 3 days (cut early due to fear)

- Losing trades: Average 14 days (held hoping for recovery)

This creates a mathematical impossibility: you're giving losses more time to compound while limiting your winners' potential. No risk management system can overcome this fundamental flaw.

How Duration Tracking Fixes Bad Habits

1. Pattern Recognition Through Data

You can't fix what you can't see. Duration tracking reveals your actual behavior versus your intended strategy.

Without tracking: "I think I'm disciplined about cutting losses." With tracking: "My losing trades average 12 days, but my winners average 4 days."

The data doesn't lie. Your habits become undeniable when measured objectively.

2. Imposes Discipline on Losing Positions

Once you start tracking duration, holding a losing trade past your average becomes a conscious choice rather than an unconscious drift into accidental investing.

The awareness question: "Why am I holding this loser longer than my typical winner?"

This forces you to either cut the loss or admit you're abandoning your trading strategy for hope.

3. Raises Awareness to Your Emotional Patterns

Duration tracking reveals when emotions override strategy. You'll notice patterns like:

- Holding losers longer during stressful periods

- Cutting winners faster after recent losses

- Extending losing trades when you're "sure" about the company

The uncomfortable insight: Your conviction often correlates with how long you're willing to lose money, not how likely you are to be right.

Odean's performance analysis proves this approach backfires: The winning stocks that investors sold for "quick profits" continued to outperform the losing stocks they held by 3.4% over the following year. Those who held losers expecting them to "bounce back" watched their winners continue winning without them.

Implementation: What to Track Starting Today

Add these columns to your trading journal:

- Entry date

- Exit date

- Trade duration (days/weeks)

- Win/loss classification

Monthly analysis: Calculate average duration for winners vs. losers. If your losing trades consistently last longer than your winning trades, you're accidentally investing instead of trading.

The goal isn't perfect ratios—it's awareness. Once you see the pattern, you can start making conscious decisions about duration instead of letting emotions control your holding periods.

The Reality Check You Need

Duration tracking won't make you profitable overnight. But it will reveal the hidden pattern that's been sabotaging your returns: giving losses more time to compound while cutting winners before they can run.

The remarkable truth: This simple calculation—counting days from entry to exit—eliminates one of the biggest reasons traders fail. Most people lose money not because their analysis is wrong, but because they systematically give their worst trades more time than their best trades.

What most traders track: Entry price, exit price, profit/loss

What profitable traders track: All of the above, plus how long they held each position

The difference between trading and accidental investing isn't your analysis—it's your discipline around time. Track duration, and you'll stop letting hope destroy your returns.

Remember: Time is money in trading. Every day you hold a losing position is a day that capital isn't working toward profitable opportunities.

Real talk: This is educational content from one professional to another, not financial advice. I'm an IT infrastructure manager sharing systematic approaches that work for my situation. Your finances, risk tolerance, and goals are unique. Please consult with a qualified financial advisor before making investment decisions.

Sources

Odean, T. (1998). Are Investors Reluctant to Realize Their Losses? The Journal of Finance, 53(5), 1775-1798.