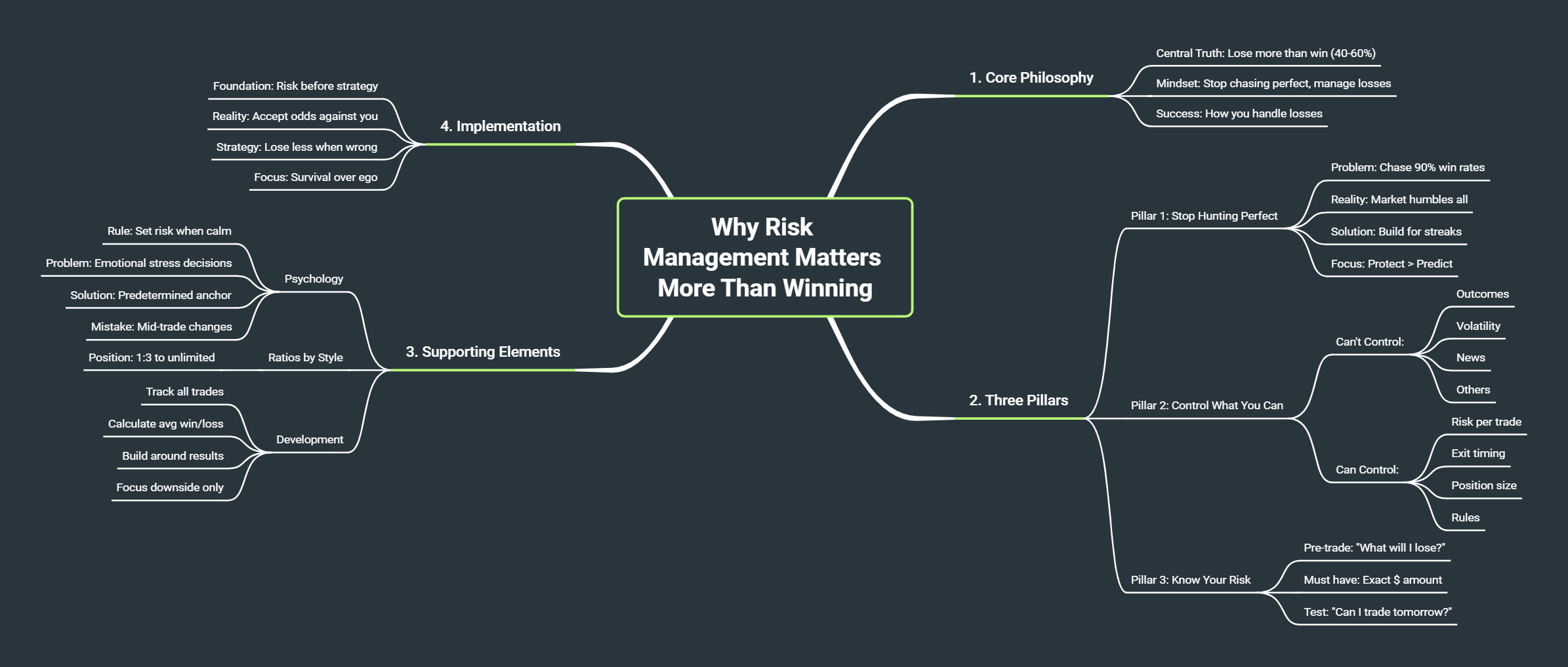

Why Risk Management Matters More Than Winning

Learn why professional traders lose 40-60% of trades but stay profitable. Master risk management over win rates for long-term trading success.

You're going to lose more trades than you win. Accept it now, or let the market teach you this lesson the expensive way.

The Uncomfortable Truth About Trading Success

Most traders chase the perfect system like it's the Holy Grail. They backtest strategies, optimize indicators, and convince themselves that the next setup will finally crack the code. Here's what they don't want to hear: you will lose more than you win, and no system changes that fundamental reality.

Professional traders win roughly 40% to 60% of their trades. The difference between profitable traders and everyone else isn't their win rate—it's how they handle the losses that define their long-term success.

Three Pillars of Effective Risk Management

1. Stop Hunting for Perfect Systems

The market humbles everyone eventually. Instead of seeking the mythical strategy that wins 90% of the time, focus on building systems that protect you during the inevitable losing streaks.

What matters: Your worst losing streak won't destroy your account.

What doesn't: Finding the perfect entry signal.

Risk control becomes your edge when most traders are blowing up their accounts chasing higher win rates.

2. Control What You Can Actually Control

The market will do what it wants, regardless of your analysis, predictions, or hopes.

You can't control:

• Whether your next trade wins or loses

• Market volatility or sudden news events

• How other traders react to the same information

You can control:

• How much you risk per trade

• When you exit losing positions

• How you size your positions based on conviction

This is why stock tips from others destroy accounts. Without understanding your own risk management, you might win ten times in a row—but two losses could wipe out everything and force you out of the market permanently.

Stop trying to predict the future. Start managing the present reality of uncertainty.

3. Know Your Risk at Every Moment

Before you click "buy" or "sell," answer this question: What am I willing to lose on this trade?

If you can't give an exact dollar amount, you're gambling, not trading. Every position should have a predetermined risk level that won't materially impact your account even if it goes to zero.

The risk awareness question: "If this trade completely fails, will I still be able to trade tomorrow with the same confidence?"

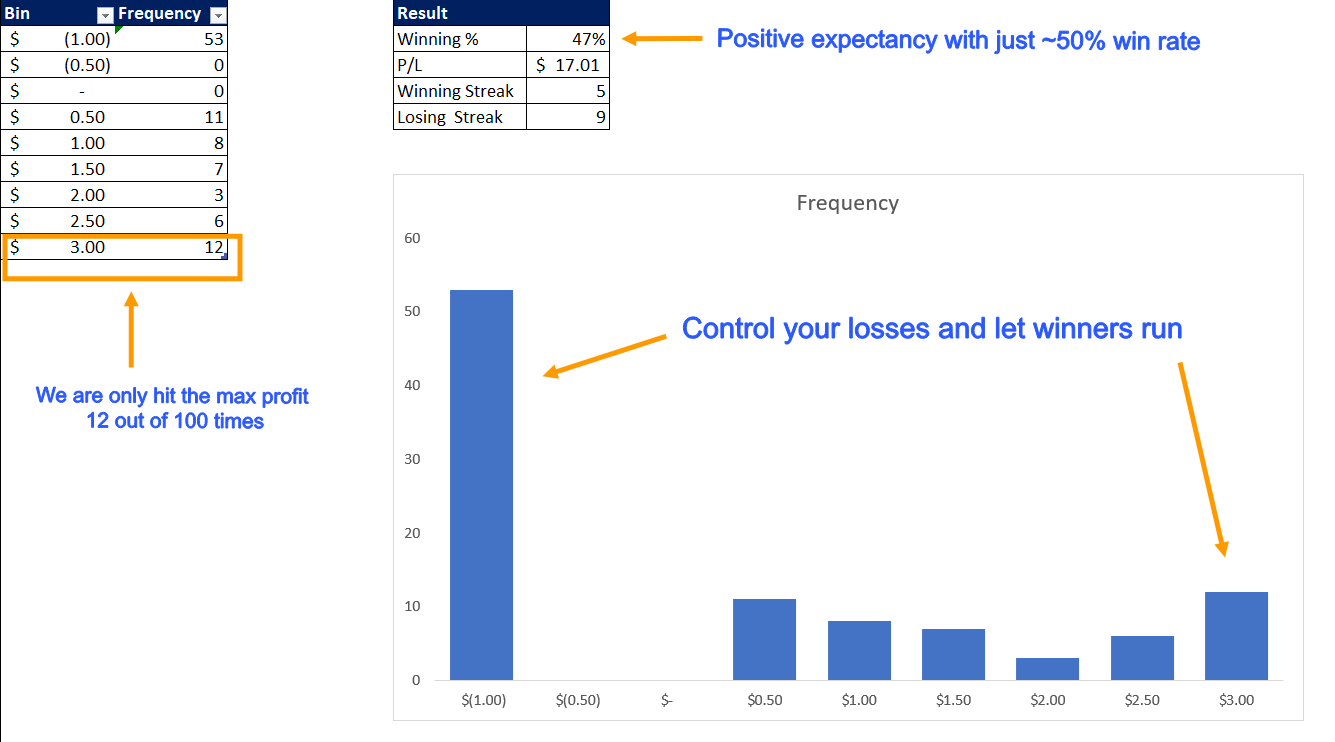

The Coin Flip That Changes Everything

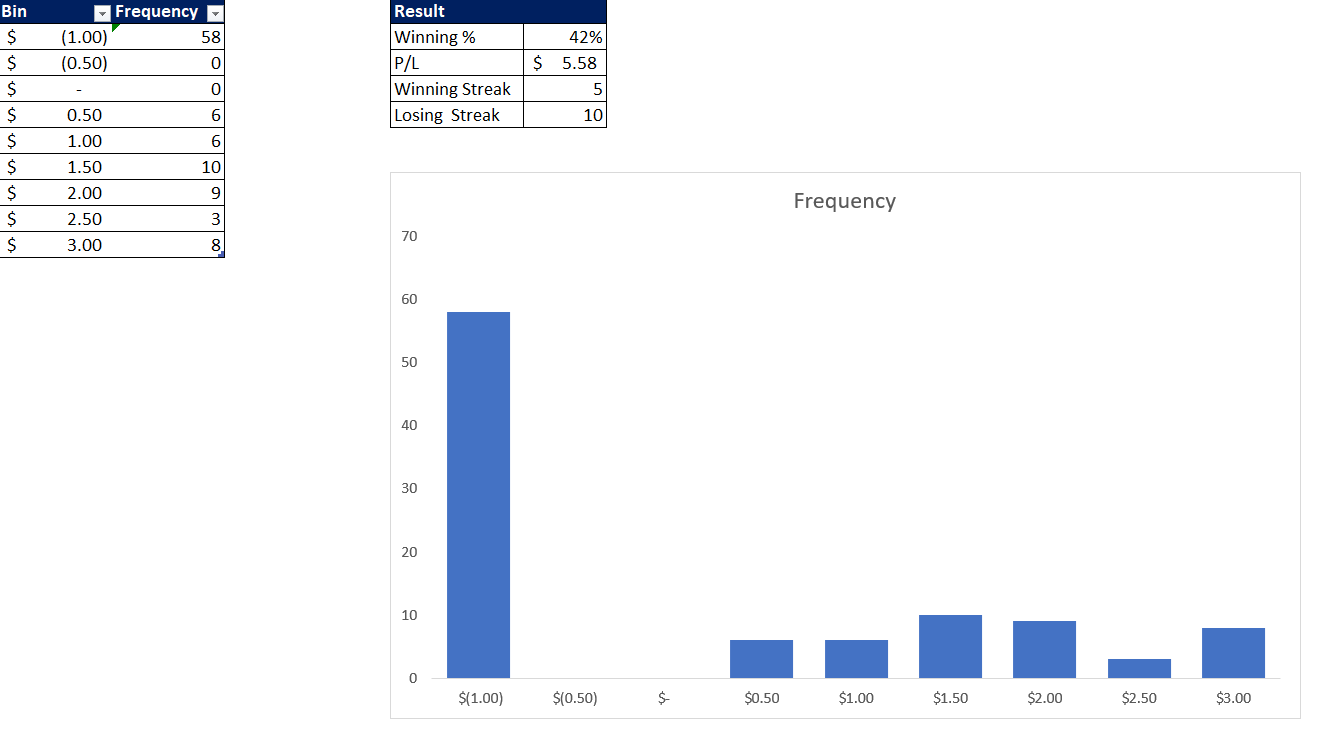

Here's proof that you don't need perfect analysis to profit: imagine flipping a coin 100 times where tails costs you $1, but heads wins you anywhere from $0 to $3.

With a 50% win rate: You're profitable even with random entries.

With a 40% win rate: You're still breaking even despite being wrong 60% of the time.

This isn't theoretical—it's the mathematical reality of trading. Your edge isn't predicting the future; it's controlling your downside while letting your upside run freely.

I've attached the Excel sheet so you can test this for yourself.

Does this calculation have flaws? Absolutely. We're not accounting for black swan events, position sizing based on volatility, or what happens if you lose 15 times in a row (roughly a 1% chance, but it can happen). These are excellent questions that we'll address in future risk management discussions.

I'm acknowledging these limitations upfront—we'll tackle every concern as we build out the complete framework.

The Psychology of Predetermined Risk

Set your risk when you're calm, not when you're bleeding money.

The moment you enter a trade, your brain shifts into survival mode. Fear and hope cloud your judgment. That analysis you trusted five minutes ago? Now it feels wrong. The stock that "should" bounce at support? Maybe it breaks through.

This is why predetermined risk isn't just a number—it's a psychological anchor. When you decide your maximum loss before entering the trade, you're making that decision from a rational state of mind. You're not watching red numbers tick against you or feeling the emotional weight of being wrong.

The fatal mistake: Changing your risk mid-trade because "the analysis still looks good." You're now making decisions under stress, in a chaotic environment where your judgment is compromised. Stick to the plan you made when your mind was clear.

Discover Your Personal Risk-Reward Ratio

In the Excel sheet, I'm using a ratio where I win $3 for every $1 I risk. This is my personal ratio developed over five years of trading. The 1:3 ratio is just an example—your actual ratio will be unique to your trading style and market approach.

After trading for several months, you'll notice patterns in your wins and losses that reveal your natural risk-reward profile:

Some traders might find:

• Day traders: 1:1.5 to 1:2 ratios with higher win rates

• Swing traders: 1:2 to 1:4 ratios with moderate timeframes

• Position traders: 1:3 to unlimited upside with longer holds

The specific number matters less than understanding what YOUR ratio actually is. Track your trades, calculate your average win versus average loss, and build your risk management around those real results.

We'll discuss this in much more detail when we establish your trading journal.

The unlimited upside advantage: This website focuses on position trading. Position trading with no predetermined exit targets means your actual reward-to-risk ratio often exceeds your initial calculations. You only need to control the downside—let the market determine your upside.

The key insight: You don't need to predict how much you'll make. You only need to control how much you'll lose.

Your Implementation Starting Point

Risk management isn't a strategy you add later—it's the foundation everything else builds on. The main point of this article is simple: structured stock trading works when you understand the risks involved. This is not gambling.

The most important point: You need to accept that the odds are against you, and you'll likely lose more than you win. That's okay. You don't need a system that wins 100% of the time. You only need a system that helps you win strategically.

The traders who survive and thrive aren't the ones who win the most. They're the ones who lose the least when they're wrong.

Remember: The market rewards patience and punishes ego. Your risk management system should protect you from both.

Real talk: This is educational content from one professional to another, not financial advice. I'm an IT infrastructure manager sharing systematic approaches that work for my situation. Your finances, risk tolerance, and goals are unique. Please consult with a qualified financial advisor before making investment decisions.